If you're a current or former military family member, understanding your healthcare coverage is essential—especially when it comes to programs like TRICARE and CHAMPVA. Though both serve military-connected individuals, they’re separate programs with different eligibility rules and cost structures.

Even more importantly, both plans leave out-of-pocket costs—but the good news is that GEA offers supplement insurance options for both TRICARE and CHAMPVA beneficiaries.

Who’s Eligible for TRICARE or CHAMPVA?

TRICARE is the Department of Defense’s healthcare program. You may be eligible if you are:

- An active duty or retired service member

- A member of the National Guard/Reserves

- A family member or survivor of a service member

- Certain former spouses

CHAMPVA is the Civilian Health and Medical Program of the Department of Veterans Affairs (VA). You may be eligible if you are:

- The spouse or child of a veteran who is permanently and totally disabled due to a service-connected disability

- The surviving spouse or child of a veteran who died from a service-connected condition

- The surviving spouse or child of a veteran who was permanently and totally disabled at the time of death

You cannot be covered under both TRICARE and CHAMPVA. If you’re eligible for TRICARE, you are not eligible for CHAMPVA.

What Do They Cover?

Both programs offer coverage for:

- Doctor visits

- Hospital care

- Mental health services

- Prescription drugs

- Preventive services

However, each program has different cost-sharing requirements and coverage limitations. That’s where supplement insurance comes in.

Out-of-Pocket Costs to Consider

TRICARE beneficiaries may pay for:

- Annual deductibles

- Copays for doctor visits or prescriptions

- Cost shares for hospital stays, outpatient care, and specialty services

- Brand-name medications like Ozempic, insulin, or specialty drugs

CHAMPVA beneficiaries are responsible for:

- A $50 annual deductible per individual ($100 per family)

- 25% of the VA-determined allowable amount for most services and prescriptions

GEA Offers Supplement Insurance Plans for Both

TRICARE Supplemental Insurance Plan

If you’re covered by TRICARE, GEA’s group TRICARE Supplemental Insurance Plan can help pay for what TRICARE doesn’t. This includes:

- Copayments

- Deductibles

- Cost shares

- Prescription expenses—even for expensive brand-name drugs like Ozempic

Highlights:

- Use any TRICARE-authorized provider

- No network restrictions

- Fast and easy claims process

- Portable coverage that stays with you even if you change jobs

Learn more or get a quote »

CHAMPVA Supplemental Insurance Plan

If you’re a CHAMPVA beneficiary, GEA also offers a CHAMPVA Supplemental Insurance Plan to help manage your healthcare costs. This plan works alongside your CHAMPVA benefits to reduce your 25% cost share and helps with rising medical and prescription costs.

Highlights:

- Helps cover the cost of doctor visits, hospital stays, and prescriptions

- Pays benefits directly to you or your provider

- Same trusted claims process and flexibility as the TRICARE supplement

Learn more about the CHAMPVA Supplement Plan »

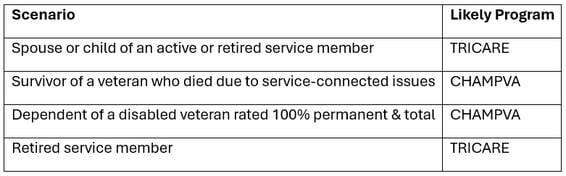

Not Sure Which Program You Have?

Here’s a quick comparison:

Final Thoughts: Protect Your Health and Your Finances

TRICARE and CHAMPVA provide critical coverage—but they don’t cover everything. Whether you’re paying cost shares, deductibles, or managing recurring prescription costs like Ozempic or insulin, a supplement plan can help lighten the financial load.

GEA offers affordable, flexible supplement insurance plans tailored specifically for military-connected families like yours. It’s peace of mind—and a smart investment in your health.

Ready to Get Covered?

Whether you’re a TRICARE or CHAMPVA beneficiary, GEA has a supplement insurance plan for you. Get the coverage you deserve—without the financial surprises.

Explore Your Supplement Options Today »